Family Care

Employees today have a variety of family care challenges that impact their ability to be their very best at work

By offering our Family Care benefit, you can help them solve these challenges by giving them access to a network of care providers, support helplines and a care budget to contribute towards those unexpected costs, enabling them to be physically and emotionally present at work

76%

of working parents have had to take a day off work unexpectedly to meet childcare requirements1

41%

of employees stated ‘Benefits and services that help with the cost of living are the top reasons for staying, above professional development and training’1

77%

of those with eldercare responsibilities consider eldercare support before accepting a new job or promotion1

Empower Your Team and Support Working Families

Decrease absenteeism

Enhance employee retention

with a benefit that working families will love

Drive D&I Initiatives

by supporting the workforce from hire to retire

Improve work-life balance

The benefits for your business

With Family Care, your organisation will benefit from:

-

The flexibility to set a budget and limits on cost per care session

-

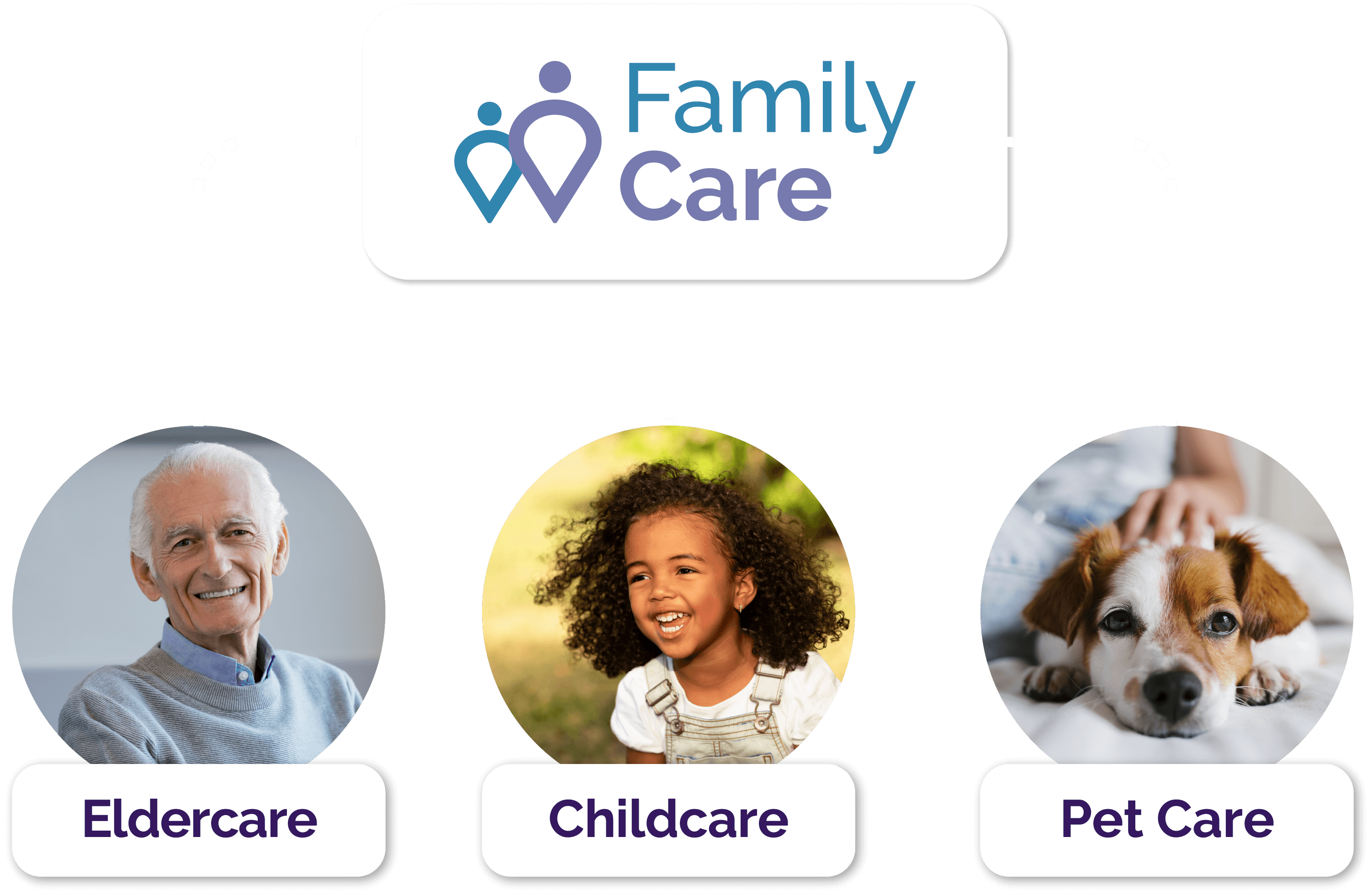

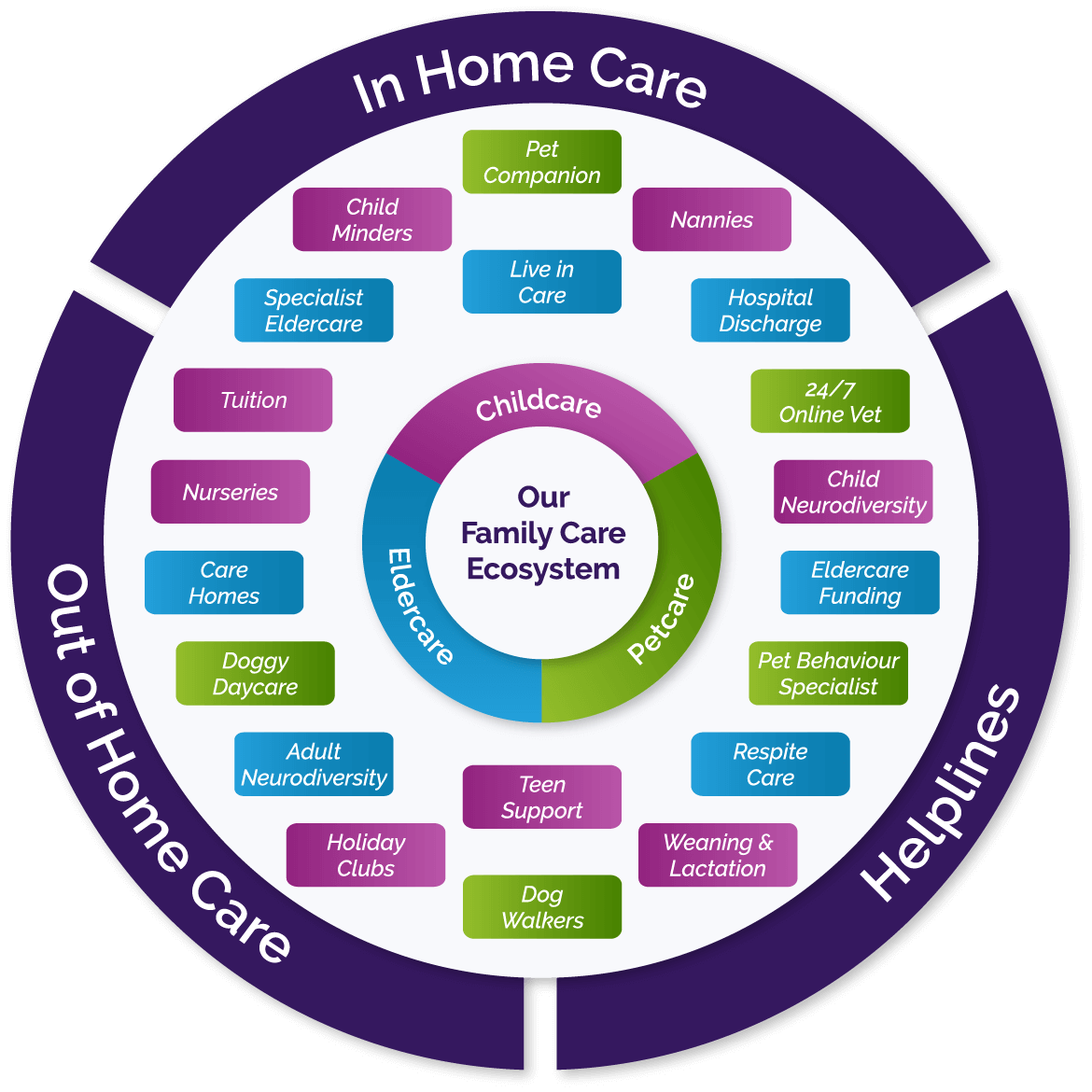

The ability to choose which services to support, including specialised pet care, childcare, and eldercare support

-

The ability to track ROI by measuring how usage supports attendance, productivity, performance, and engagement

-

Easy team onboarding and set-up

How this benefit will empower your employees

By implementing Family Care in your organisation, your workforce will enjoy:

-

A wide range of care options from a database of 14,000 childcare providers, 4,000 tutors, 15,000 eldercare providers, and 3,000 pet care providers

-

The ability to use their own trusted network

-

Access to over 30 helplines for children, pets, and elder family members – including specialised services for neurodiversity

-

Flexibility to use their budget in the best way to suit their family needs

FAQs

What is included in the platform fee?

The platform fee includes the search care function with 97% UK coverage, helplines to over 25 experts and advisors, 24/7 vet services, resources and content to guide decision processes, and member discounts and sales vouchers for expensing and reporting.

What makes our ‘Family Care’ benefit different to competitors?

We do not book care directly. Instead, we signpost to services, giving people complete flexibility over the care they choose, increasing fulfilment rates, and allowing people to use who they want, including their own network, without inflated fees or restricted choice.

What quality assurance do you offer?

We signpost to several experts and advisors for emotional support, and we carry out due diligence in terms of insurance and qualifications. When searching for physical care, all childcare providers in England have an Ofsted rating of ‘Good’ or ‘Outstanding, and our Eldercare providers across the UK have a ‘Good’ or ‘Outstanding’ rating with CQC.

Do I have to add a Care Budget?

No. You can simply give your employees access to the platform with all the above included. Adding a Care Budget offers your employees support to arrange and book care when otherwise they would be absent from work.

How much Care Budget should employees be given?

We can advise on how much budget to allocate per employee based on average cost of care, and number of days you would like to cover.

Do all categories have to be offered?

No. As an employer, you can choose whether to support Child, Eldercare, and Pet care, or just one or two. For DE&I, we would recommend switching on all three, as ‘family’ is a broad term!

Is the Care Budget taxable?

Yes, this is a taxable benefit and can be executed in 3 ways:

- Report the Benefit in Kind (BIK) via a P11D submission. The tax due will be collected over the course of the following year through a tax code adjustment.

- Deduct the tax due at source through payroll (PAYE). The tax due will be deducted from the employee’s monthly salary.

- Make a PAYE settlement (PSA). The tax due will be paid by you, the employer, removing tax liabilities from the employee.

Vivup are not able to provide tax advice and would recommend seeking your own advice. For specific questions in relation to the tax, NICs and how to report this, independent tax and/or legal advice should be sought.

Will I receive MI Data?

Yes, as an employer, you can see how the platform is accessed, the types of care that employees are interested in, and how the Care Budget is used, all by location, department or even by job title, giving insight into the family support they need, as well the ability to ‘put an arm around them’ when they need it most.

Request a Family Care Demo

1 2023 Modern Families Index